5 Myths About RCM That Hurt Rural Health Providers

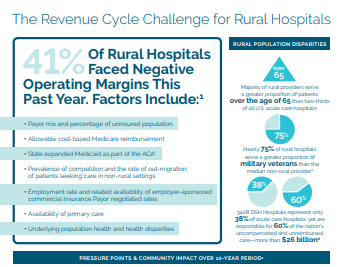

Rural communities are on the brink of a healthcare epidemic. With nearly 20% of rural hospitals at a high-risk of closing due to insolvency, providing quality patient care isn’t the only thing lost in a healthcare desert. These facilities are often a pillar within their community, not only being the one shop in town for healthcare needs, but they are often the largest employer. These financial strains impact much more than the facility, they impact the community the hospital serves. For example, when a hospital in the community closes, the average per capita income drops by 4% and unemployment rises by 1.6%. These statistics are not a good prognosis for the rural communities that make up the heartbeat of our country.

Financial strains aren’t limited to just rural hospitals. Clinics in rural communities are also struggling. According to the 2019 Rural Health IT Survey, declining reimbursements are the number one challenge that rural health facilities are facing. The number three challenge is improving billing processes and managing denials. No wonder so many physician’s report feeling burned out. Knowing these challenges, it makes sense that the number one reason rural health facilities look to outsource their revenue cycle is in order to seek higher reimbursements. Capturing every dollar is critical to ensure financial sustainability and profitability. And to keep your facility’s doors open to the patients and community you serve.

With these financial challenges in mind, let’s take a look at five revenue cycle management (RCM) myths we commonly hear and see how they are impacting revenue.

Myth #1: Patients are only a small portion of the payer mix

Myth #2: Financing plans are only for hospitals

Myth #3: Patient engagement doesn’t impact revenue

Myth #4: It doesn’t pay to offer telehealth

Myth #5: You won’t get your investment back with RCM technology

Myth #1: Patients are only a small portion of payer mix.

From 2007 to 2017, out-of-pocket patient expenses increased by 230 percent. Patients are now the third-largest payer, encumbered with increasing financial responsibility for their healthcare costs. Even within Azalea’s RCM customer base, we saw patient collection grow seven percent from 2017 to 2018. Nationwide, a greater portion of the rural population is more likely to be uninsured, especially in states that did not expand Medicaid. Rural clinics and hospitals therefore need to place greater emphasis on providing accurate patient estimations before delivering care and also collecting fees upfront. It is also worth noting that as patients become more aware of their healthcare costs, price transparency is becoming increasingly important. Providing estimations of a service or procedure upfront can help alleviate the surprise factor of a healthcare bill the patient receives. Improving point of service and patient collections up front can help reduce bad debt and write offs.

Maximizing Reimbursements

Declining reimbursements rank as the top challenge facing rural healthcare providers, according to the recent State of the Industry: Top Trends for Rural Healthcare Providers. Learn how to overcome this obstacle and how to maximize reimbursements in your practice.

In this webinar we’ll cover best practices for charge capture & claims submission, payment processing, patient registration & financial clearance, denials management & AR follow-up.

Myth #2: Financing plans are only for hospitals.

In general, patients are struggling to pay medical bills in full. And this isn’t just in hospital settings. In fact, nearly 7 in 10 Americans with medical bills of $500 or less in 2016 didn’t pay the full balance — up from 49 percent in 2014 — per a June 2017 TransUnion report. And according to a recent Kaiser/HRET Survey, 51 percent of covered workers in 2017 reported an annual deductible of $1,000 or more for single coverage, up from 34 percent in 2012. The bottom line: more patients will be seeking low-interest financing options to pay their medical bills from this point forward.

Simply giving patients the option of no-interest or low-interest financing has the potential to increase self-pay A/R and reduce bad debt. Think about it: if patients know they can avoid defaulting on a bill and hurting their credit by paying off healthcare costs in regular, monthly increments with little or no interest, they’ll be more inclined to work with an organization.

Myth #3: Patient engagement doesn’t impact revenue.

Patient engagement used to just mean talking with patients and sending them a letter when they hadn’t been seen in awhile. In today’s digital world, patient engagement is much more all-encompassing. Everything from patient portals, to appointment reminders, to chronic care management can serve to not only provide better care, but also drive revenue to a facility’s bottom line. More than 50 percent of practices leverage appointment reminders to reduce no-shows. Facilities deploying CCM programs are reimbursed by CMS. Patient portals provide opportunities for patients to pay their bills electronically, accelerating revenue capture.

And while it is true that rural communities have higher populations of adults ages 65 of older, according to Pew Researcher, seniors are “more digitally connected than ever,” with more than 4 in 10 adults ages 50 and over using smartphones. That figure climbs to 59 percent for the 65- to 69-year-old set.

Myth #4: It doesn’t pay to offer telehealth

As a matter of fact both Medicare and Medicaid make it easy by posting lists of covered telehealth services by CPT code on their web portals. Medicare and Medicaid (differs by state) also post their reimbursement guidelines online. The reimbursement for these services are paid at the same amount as if the patient was on-site with the provider. While commercial payers can vary, there are several free analysis reports available online that offer guidance on telehealth coverage and reimbursement for both government and commercial payers on a state by state basis. Making sure your providers are properly credentialed with payers and licensed in the states in which they expect to treat patients is an important part of the process.

Rural patients face nearly double the travel time to reach their local hospital than their urban counterparts, telehealth provides a revenue-driving alternative, according to recent research. Providing telehealth not only drives new revenue streams to the clinic, but also provides a more convenient care delivery method for patients who need it.

How To Guidelines For Split Billing Medicare Claims

Myth #5: You won’t get your investment back with RCM technology

With cloud-based solutions, this is not the case. By integrating financials with patient portals, offering electronic payment options, sending electronic statements and reminders, and even enabling patients to pre-pay for services, the back-office has come a long way. Rural clinics and hospitals can take it a step further and outsource their complete RCM process. According to the State of the Industry Report: Top trends for Rural Healthcare Providers in 2019, 72 percent of respondents’ number one reason for outsourcing revenue cycle is due to seeking higher reimbursement.

To ensure you are making wise investments, track key performance indicators such as days in accounts receivable, claims filed within seven days of services and EDI rejection rates. Start with your benchmark and then track improvements until you are at least meeting industry standards that are documented by organizations such as the HFMA. Azalea clients have found that leveraging our coders, who are certified in rural billing practices, they have reduced days in A/R and lowered their claim rejection rates to the point where they are outpacing industry averages by more than 10 days and 1.4 percent respectively. All of this results in stronger reimbursement and strengthening cash flow that makes provides quantifiable ROI on the technology and services investment.

Moving Beyond the Myths

Once rural health organizations have embraced the reality of RCM — and are ready to tackle some of their biggest in-house billing challenges — there are three initial steps to take.

- Success begins at the front desk. Educating patients on the cost of care and offering them the opportunity to pre-pay for services, can help avoid confusion and frustration later on.

- Align your RCM goals. Communicating goals – from streamlining claims processing to managing denials and A/R follow-up more efficiently – both internally and with vendor partners will ensure benchmarks are set and expectations measured.

- Support physicians in providing the best care to patients. Doctors shouldn’t be encumbered with business worries – that’s the administrative staff’s job. We should seek better RCM partners and technology solutions when it makes sense. This is especially important as we move deeper into collaborative care, which brings more dynamic patient billing scenarios — e.g., patients who are seen by multiple primary-care and specialty providers, such as psychiatrists or rheumatologists.

Don’t take yesterday’s reality as today’s facts. Once we embrace the truth of today’s rural, patient and RCM landscapes, we can take on any RCM challenge the universe brings us.

Doug Swords is Azalea Health’s co-founder and VP of RCM, changing the way health IT platforms connect community-based healthcare providers and patients across the lifecycle of care.

22 Tips & Tricks to Increase Practice Reimbursements

Ask yourself: Are we consistently collecting patient co-pays? Are our patients paying on time? Are more than 4% of our claims being rejected? Do we have a monthly period close process? If you can’t answer “yes” to all of these questions, this list is for you!

Learn quick and easy ways to enhance your collection process and increase practice reimbursements