How Can You Maximize Patient Reimbursements?

By Sarah Cherry, Director of RCM Operations – Azalea Health

- Be transparent. Introduce the patient financial conversations up front.

- Go green. Go paperless. Go electronic.

- Reduce A/R. You can’t measure what you don’t track.

10 years ago patients wouldn’t think twice about paying for healthcare services because insurance companies covered almost everything. High deductible plans weren’t as common and regulations weren’t as stringent. Today, things are much different. According to a TransUnion healthcare report, patient responsibility increased 11% in 2017. With the increase in patient financial responsibility and the decline in reimbursements, it is no surprise that healthcare practices and facilities are struggling to adapt, survive and thrive.

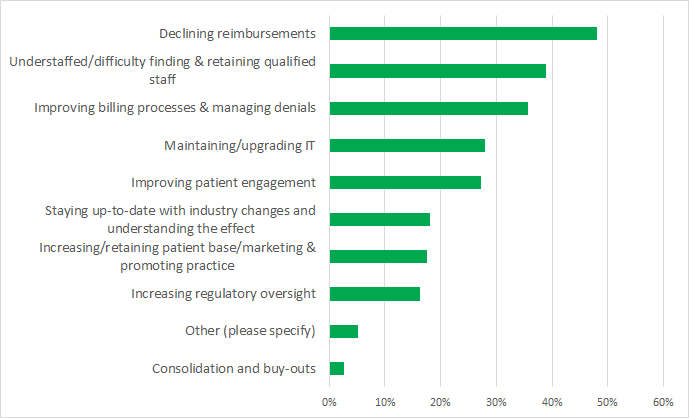

According to the 2019 Rural Health IT Survey, the number one challenge identified by rural healthcare providers and administrators is declining reimbursements. Even more senior-level respondents flagged reimbursements as an issue – 72%. Rounding out the top three is improving billing processes and managing denials. It’s not surprising that revenue cycle challenges are two of the top three challenges rural healthcare providers face. Other notable challenges include patient engagement, staffing, physician burnout and infrastructure. So how do you overcome these challenges? Here are three of our favorite best practices we share with our customers.

22 Tips & Tricks to Increase Practice Reimbursements

Ask yourself: Are we consistently collecting patient co-pays? Are our patients paying on time? Are more than 4% of our claims being rejected? Do we have a monthly period close process? If you can’t answer “yes” to all of these questions, this list is for you!

Learn quick and easy ways to enhance your collection process and increase practice reimbursements

1. Be transparent. Introduce the patient financial conversation up front.

Not many people enjoy surprise bills. This includes patients who receive a bill months after a visit they may or may not remember they had. With the rise of high deductible health plans and patient responsibility, collecting every patient dollar at the time of service is critical to your practice’s success. Have your front desk staff utilize conversation scripts that ask the patient to pay upfront (“Our records show that your copay for this visit is $40. How would you like to pay that today?”). By introducing the financial component earlier in the conversation, the patient is less likely to have a surprise bill and more likely to pay on the spot.

2. Go green. Go paperless. Go electronic.

Did you know that over 50% of patients would prefer to receive their bills electronically? Makes sense as that’s the way we pay other bills such as our household utilities and cell phones. And yet, 77% of healthcare providers are still sending paper bills via mail. Adopting an eStatement solution allows patients to receive patient statements the way they want them: in their inbox. Eliminate barriers to payment by pairing eStatements with an online payment solution, patient-facing mobile app, or auto-charging cards on file. An added bonus for your practice: save money on postage and time by not stuffing paper statements!

3. Reduce A/R. You can’t measure what you don’t track.

One common area for revenue leakage lies within denials and A/R follow up. Understanding the industry benchmarks, how they are calculated, and where your practice stands will help you set goals for reducing A/R within your practice. There are many standard industry metrics your practice can track including:

- Keeping denials under 5%

- Total A/R over 120 days old should be less than 12%

- Average days in A/R should be under 40 days

Make sure your practice is frequently reporting on these metrics or whatever metrics you decide to monitor. Doing this analysis on a consistent basis will help identify any negative trends or large bucket shifts over time. Also, don’t forget to follow up on A/R regularly, at least every 30 days. Working the full A/R report, not just days within a specific date range of A/R, will help uncover missed revenue.

To learn more best practices for improving your revenue cycle management operations and maximizing reimbursement, you can listen to the full recording of our webinar.

If you are interested in a free financial analysis of your practice and how you compare to the industry averages, you can request one here.

Don’t let manual and inefficient processes keep you from getting paid. Take the initiative to automate and make improvements to your revenue cycle today!

5 Myths About RCM That Hurt Rural Health Providers

Rural communities are on the brink of a healthcare epidemic. With nearly 20% of rural hospitals at a high-risk of closing due to insolvency, providing quality patient care isn’t the only thing lost in a healthcare desert.

With these financial challenges in mind, let’s take a look at five revenue cycle management (RCM) myths we commonly hear and see how they are impacting revenue.