QPP 2019 Eligibility

What Is The Quality Payment Program?

The Medicare Access and CHIP Re-authorization Act of 2015 (MACRA) was signed into law with bipartisan support on April 16, 2015 and went into effect on January 1, 2017. The law does many things but most importantly it establishes a new payment methodology based on how clinicians and groups of clinicians care for Medicare beneficiaries. It is comprehensive legislation that has significantly restructured U.S. healthcare.

The QPP replaces the Sustainable Growth Rate (SGR) Formula that formerly determined Medicare Part B reimbursement rates. Reimbursement under the QPP how hinges on patient care value and outcomes.

There are two paths to participation that focus on incentive’s for care quality rather than volume.

What is the Merit-Based Incentive Payment System (MIPS)?

The MIPS is a pathway that consolidates the Physician Quality Reporting System (PQRS), the Value-based Payment Modifier (VBM) and the Medicare Electronic Health Record (EHR) Incentive Program into one single program. “MIPS was designed to tie payments to quality and cost efficient care, drive improvement in care processes and health outcomes, increase the use of healthcare information, and reduce the cost of care.”¹

Check your MIPS eligibility HERE.

MIPS Individual vs. MIPS Group Participation

When a clinician is included in MIPS, there must be a decision made as to whether to report as an individual or group. The 2019 Eligibility Checker will be available sometime in Q1 2019.

- Individual: An individual is a single clinician’s NPI tied to a single TIN. If MIPS data is reported as an individual, the payment adjustment will be based only on that individual clinician’s performance in the program and payment adjustments will only be applied to that individual clinician’s Part B reimbursement (2 years following the Performance Year).

- Group: A group is a set of clinicians (which could include eligible and non-eligible) who bill Medicare Part B under a single common Taxpayer Identification Number (TIN), no matter the specialty or practice site. If MIPS data is reported as group, the payment adjustment is based on the group’s performance (2 years following the Performance Year).

- Virtual group): A Virtual Group is a combination of two or more Taxpayer Identification Numbers (TINs) made up of solo practitioners and/or groups of 10 or fewer eligible clinicians who come together “virtually” (no matter specialty or location) to participate in MIPS for a performance period of a year.³

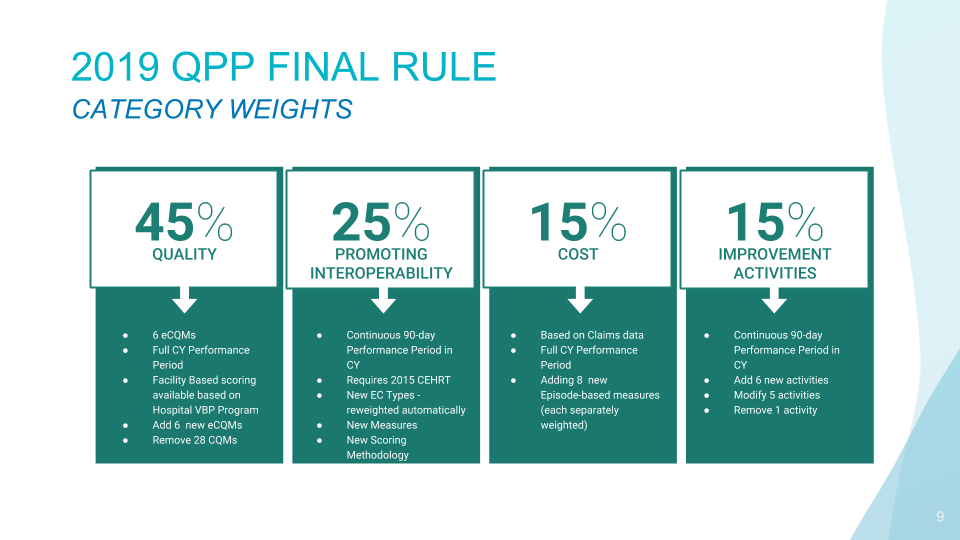

The MIPS Composite Score

The MIPS Composite Score (0-100) is calculated based on data submitted in 4 weighted categories and determines an eligible clinician’s (EC) or group’s overall performance in the MIPS Program.

The Composite Score is ultimately the tipping point for whether an EC or group receives a positive, neutral or negative payment adjustment (2 years following the Performance Year). The MIPS Composite Score can significantly impact a provider’s Medicare reimbursement in each payment year from -9% to +27% by 2022.

The MIPS Performance Program Year is based on the calendar year and participation is required annually.

What Are Alternative Payment Models (APMs)?

APMs offer a collaborative way to manage Medicare Part B beneficiaries, receive payment for services and earn incentives for providing high-quality, cost-efficient care as a whole. It also requires an application process and acceptance of risk.

Participation still requires collection and submission of the 4 MIPS categories, though the scoring methodology is a bit different.

Advanced APMs participants earn a 5% incentive in 2021 for participation in 2019 if:

- You receive 25 percent of your Medicare Part B payments through an Advanced APM or

- See 20 percent of your Medicare patients through an Advanced APM

Advanced APMs required you to collect and submit quality data to your Advanced APM.

The list of Advanced APMs is expected to update annually.

Starting in Performance Year 2019, eligible clinicians will be able to become Qualifying Alternative Payment Model Participant (QPs) through the All-Payer Option. To attain this Option, eligible clinicians must participate in a combination of Advanced APMs with Medicare and Other-Payer Advanced APMs. Other-Payer Advanced APMs are non-Medicare payment arrangements that meet criteria that are similar to Advanced APMs under Medicare.

How is Azalea Health prepared to assist me with the Quality Payment Program?

Azalea EHR 3.0 (ambulatory) and ChartAccess 6.0 (acute) is certified to the ONC 2015 Edition Certification through Drummond (ONC-ACB)..

Azalea helps clients navigate everything from participation strategy and measures selection, to actually pulling the proper data and submitting successfully. Our goal for clients is to not simply to avoid penalties, but to qualify and take full advantage of the available positive adjustments.

Please contact your Client Engagement Specialist to learn more about our available QPP support options.

We also have valued partners that can assist with QPP, learn more here.

¹QPP Website (https://qpp.cms.gov/mips/overview)

²QPP Website (https://qpp.cms.gov/participation-lookup/about)

³QPP Website (https://qpp.cms.gov/mips/individual-or-group-participation)

Click to view information for 2018 QPP requirements

Click to view information for 2019 QPP Requirements