Rural Providers Are Dreaming Big, But Not Acting Big.

Our third survey of rural healthcare providers yielded many interesting insights about their challenges, IT use and wish list. Deciphering the results from our more than 150 rural healthcare respondents yielded perhaps the most important finding of all – rural providers are eager for technology advancement but they are not taking the necessary steps to make that vision a reality. In this report you’ll learn:- Top seven factors preventing rural healthcare organizations from technology adoptions or upgrades

- Rural provider growth plans for the next five years

- Three top trends for rural providers in 2019

- Organic growth

- Enhanced capabilities in patient monitoring and care

- Improved profitability

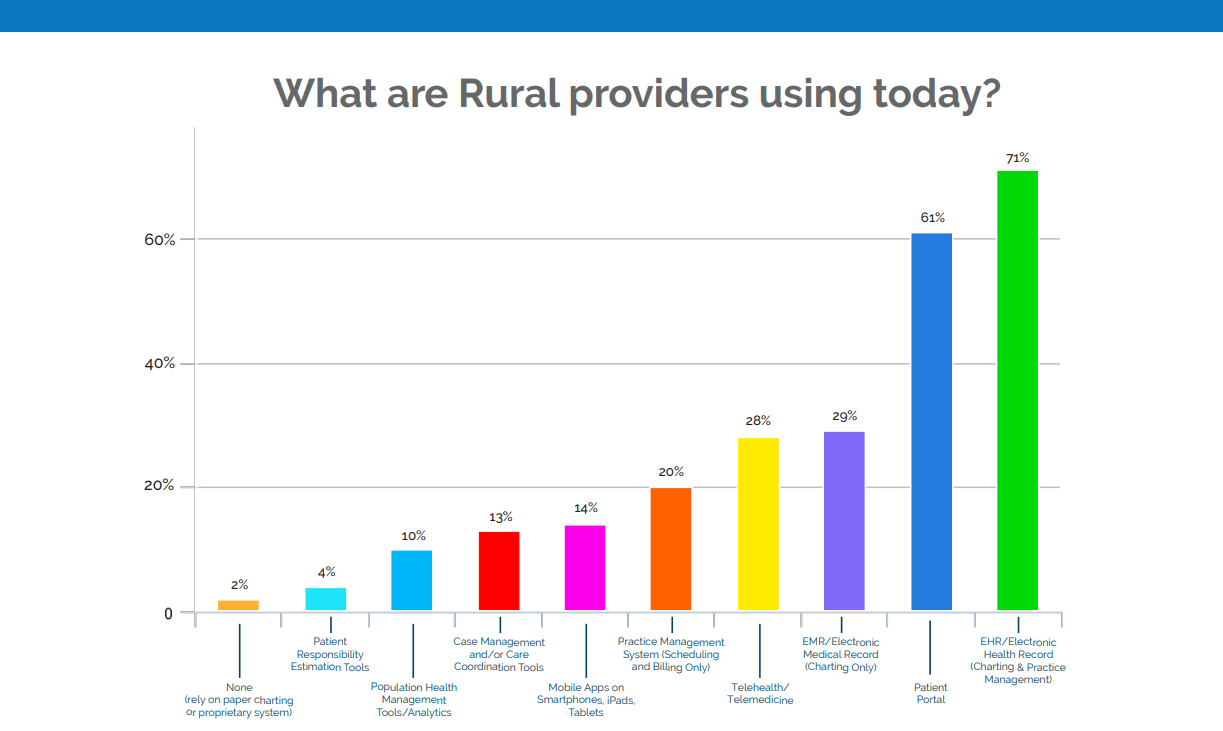

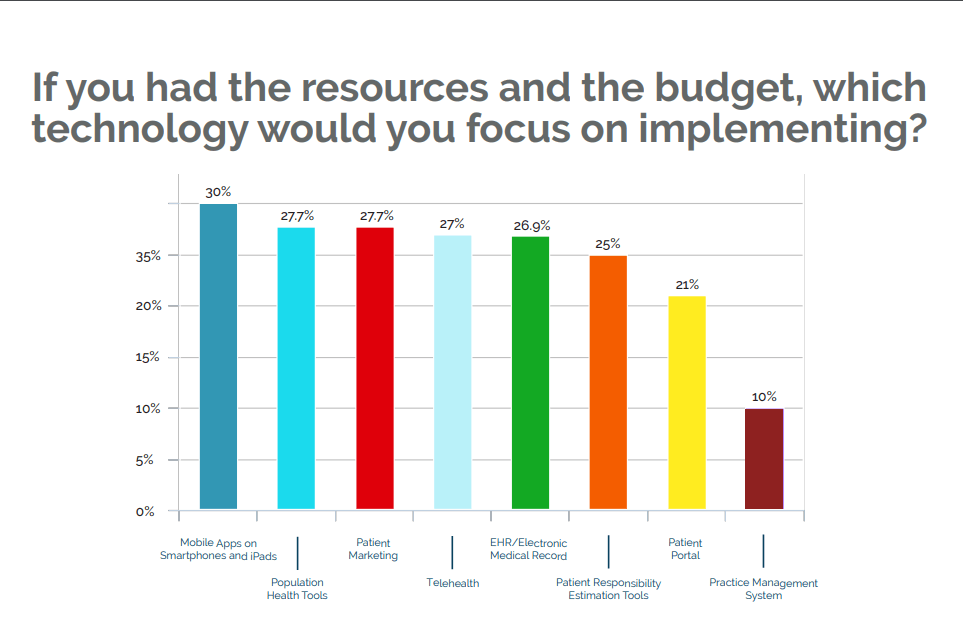

The desire for mobile apps is particularly strong among independent primary care and specialty clinics (44%), while critical access hospitals are especially interested in patient responsibility estimation tools (25%).

The desire for mobile apps is particularly strong among independent primary care and specialty clinics (44%), while critical access hospitals are especially interested in patient responsibility estimation tools (25%).

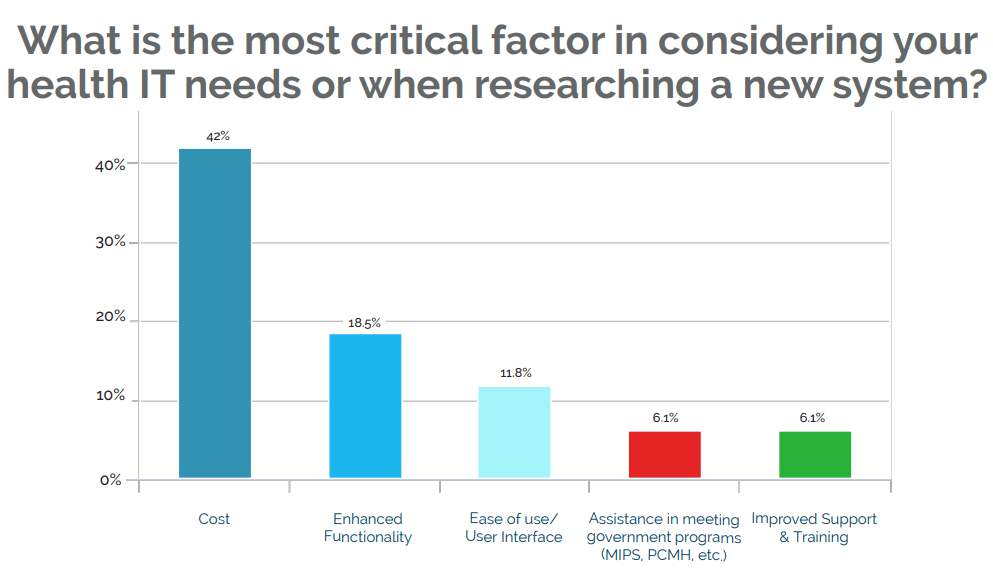

This is the 3rd consecutive survey where cost topped the obstacles preventing new technology adoption or IT upgrades. (Surveys are conducted every other year.)

But while cost continues to be the #1 obstacle —by a 24% margin—so are lack of staffing and IT resources, uncertainty around benefits and ROI of new technologies, and concerns around integrating new technologies into existing workflows.

For critical access hospitals in particular, the smaller the hospital, the more likely staffing, recruitment, and retention were to be cited as barriers to technology adoption.

This is the 3rd consecutive survey where cost topped the obstacles preventing new technology adoption or IT upgrades. (Surveys are conducted every other year.)

But while cost continues to be the #1 obstacle —by a 24% margin—so are lack of staffing and IT resources, uncertainty around benefits and ROI of new technologies, and concerns around integrating new technologies into existing workflows.

For critical access hospitals in particular, the smaller the hospital, the more likely staffing, recruitment, and retention were to be cited as barriers to technology adoption.  Not only is cost the number one barrier to adoption, it is also the most critical factor rural providers evaluate in researching new systems. The wide gap between this factor and the second-highest consideration, “enhanced functionality,” is notable.

The prevalence of inaction resulting from lack of information or fear stalls rural providers’ efforts to achieve their vision.

For example, just 22% of rural healthcare respondents plan to change their technology solutions, down from 43% in 2017—even when some services or tools, such as telehealth, are reimbursed by commercial and government insurers or have the potential to strengthen providers’ financial performance.

Not only is cost the number one barrier to adoption, it is also the most critical factor rural providers evaluate in researching new systems. The wide gap between this factor and the second-highest consideration, “enhanced functionality,” is notable.

The prevalence of inaction resulting from lack of information or fear stalls rural providers’ efforts to achieve their vision.

For example, just 22% of rural healthcare respondents plan to change their technology solutions, down from 43% in 2017—even when some services or tools, such as telehealth, are reimbursed by commercial and government insurers or have the potential to strengthen providers’ financial performance.

- 56% of rural providers did not participate in a value-based payment (VBP) program in 2018

- 35% were unsure whether they would participate in a quality reporting program in 2019, or did not plan to do so

- 25% said their primary barrier to participation in VBP programs is lack of knowledge around which programs are available or best fit their practice

- 44% cited lack of resources or training as their top barrier

Top 3 Trends For Rural Healthcare Providers

Trend #1: Identifying and overcoming reimbursement obstacles is necessary for rural providers to achieve their vision for care and service in their communities.

- The Azalea Health survey shows that 48 percent of rural providers consider declining reimbursements to be their biggest challenge. As Medicare and others in the payer mix increasingly move from fee-forservice payment to value-based payment (VBP) models, it’s clear that strengthening capabilities for value-based performance is key to organizations’ financial health. Yet few rural providers are taking action:

- Just 44 percent of rural providers participated in a VBP program in 2018, and nearly 35 percent were unsure whether they would participate in a quality reporting program in 2019 or did not plan to do so.

- Twenty-seven percent of rural providers say their primary barrier to participation in VBP programs is lack of knowledge around which programs are available or best fit their practice. This is especially true among independent rural health clinics (43 percent).

- Another 44 percent of rural providers say they don’t have the training or staff to participate in quality reporting programs.

Misconceptions Are Holding Rural Providers Back from Quality Gains

Nearly one out of five rural clinics and hospitals do not understand the benefits of population health and/or do not think it’s right for their group.

Independent and hospital-owned primary care clinics are more likely to believe their current system already supports their analytic and quality reporting needs—even though challenges around the quality reporting and administrative aspects of these programs, such as MACRA, are well known.

Some rural organizations hold back from investing in quality analytics and reporting because they fear it will open them up to security and patient privacy challenges.

For example, if lack of trained staff has kept an organization from participating in VPB models, leaders may choose to connect with other rural providers that have overcome this challenge to learn from their experiences. It’s also important to quantify the level of training required so leaders have a clear understanding of the resources needed. State rural health associations often offer free or low-cost training that can be extremely valuable from an education and networking perspective.

Rural providers also may wish to consider partnering with vendors to improve quality performance—and boost reimbursement. For example, healthcare RCM vendors can point to ways rural providers could more effectively tackle quality reporting requirements. While only 18 percent of rural providers would consider outsourcing revenue cycle management to boost revenue—even though top RCM options could increase revenue and efficiency while reducing the cost to collect—this type of partnership also could equip providers with the data analytic expertise needed to pinpoint and address gaps in care management, elevating performance under quality programs.

The Top Challenges in Rural Reimbursement

72% of senior rural health leaders, regardless of facility type, say reimbursement is their #1 challenge.

Critical access hospitals are even more likely to rank declining reimbursement as one of their top challenges:

- 80% of Critical Access hospitals with more than 5 providers

- 53% of Critical Access Hospitals with 1 – 5 providers

- 42% of Affiliated Rural Health Clinics

- 40% of Independent Specialty Care Clinics

- 40% of Hospital-owned Primary Care Clinics

- 38% of Independent Rural Health Clinics

- 33% of Independent Primary Care Clinics

- 33% of Federally Qualified Health Clinics (FQHC)

Trend 2: Mastering the psychology of patient behavior will be key to rural providers’ ability to improve performance on multiple levels.

Patient engagement—both patient financial engagement and engagement in managing chronic conditions—will be key to rural providers’ success in 2019.

With senior leaders ranking declining reimbursement as their top challenge, strengthening the ability to collect patient copays and out-of-pocket balances should be a top priority. So should investments in training and technologies that more effectively help patients take ownership for managing chronic and costly conditions.

When these conditions are not managed appropriately, this can increase hospital admissions and readmission rates, which in turn impact reimbursement.

Patient financial engagement

A common pain point for 35 percent of rural healthcare facilities surveyed is difficulty collecting from patients. At a time when nearly half of all rural hospitals are operating with negative operating margins, patient financial engagement is a necessary component for strengthening financial performance and boosting cash flow.

When staff avoid conversations around out-of-pocket costs for care, patients are more likely to forgo needed care, shop for healthcare services elsewhere, or respond angrily when bills do arrive. Waiting to have these discussions until after the patient has left the facility is also detrimental to a rural facility’s financial health.

One McKinsey study found collection rates significantly decrease after the patient visit, with providers collecting just 50 to 70 percent of the balance, on average.

However, when front-office staff master the psychology of patient behavior at the point of service, they are better positioned not only to collect copays, but also to have meaningful discussions around the patient’s total out-of-pocket cost of care. Staff then feel more empowered to request the balance in full—and patients are more likely to respond, even by paying a portion and agreeing to a payment plan.

A transparent patient financial services process is one factor that can change the psychology of patient payment. Leading healthcare organizations are increasing transparency around patient financial communications and equipping their financial services staff with the skills and the resources to compassionately and effectively lead patients through the payment process.

A transparent patient financial services process is one factor that can change the psychology of patient payment. Leading healthcare organizations are increasing transparency around patient financial communications and equipping their financial services staff with the skills and the resources to compassionately and effectively lead patients through the payment process.

These include:

- Patient responsibility estimation tools, desired by 26 percent of rural providers surveyed

- Tools that predict a patient’s propensity to pay

- Financial assistance screening tools

Providing an estimate that is specific to the individual is a differentiator between “good” and “great” communication. So is putting price information in context with the quality and safety of care the facility provides.

Offering multiple options for payment, including mobile payment, also is critical. Additionally, providers should have processes in place to help patients who may qualify for outside assistance.

Revenue Cycle Outsourcing Needs Among Rural Providers

- Rural providers consider credentialing the most likely challenge they would outsource (36

percent), followed closely by patient collections (35 percent). - Critical access hospitals (41 percent) and standalone hospitals (60 percent) are more likely to consider outsourcing their coding function compared with rural providers as a whole (24 percent).

- When it comes to transcription and prior authorization—both of which have a deep impact on revenue cycle performance:

- Standalone hospitals (60 percent) and critical access hospitals (37 percent) are more likely to consider outsourcing transcription compared with rural providers as a whole (22 percent).

- Independent rural health clinics (33 percent) and critical access hospitals (18.5 percent) are more likely to consider outsourcing prior authorization than rural providers as a whole (16 percent).

- Only 18 percent of rural providers would outsource revenue cycle management to boost revenue.

Engagement in health management

Patient engagement is critical to improving management of chronic conditions among rural residents and helping rural teens adopt better health habits. Nearly 20 percent of rural health residents describe their health status as fair or poor, compared with 16 percent of urban residents. Rural areas also are more deeply impacted by rates of heart disease, diabetes, and tobacco use among youth. When rural providers succeed in engaging patients in better management of health conditions, the benefits are numerous:- Improved performance under value-based payment models—and associated higher reimbursement

- More appropriate use of care resources—critical given the shortage of rural physicians and nurses

- Reduced costs

Rural Health Mobile App Adoption: Small Strides; Big Potential

Mobile adoption is low among all providers.

- Just 16 percent of rural providers use mobile apps.

- Rural family medicine practices are most likely to have mobile apps (42 percent).

- Rural hospitals ranked second for establishing a mobile presence (at a mere 14 percent), while rural health care centers came in third (11 percent).

Mobile apps ranked as the highest “wish list” item for all rural providers polled, at 30 percent. However, mobile compatibility ranks lowest among rural providers’ considerations when looking for new tech (less than 1 percent).

Trend #3: Awareness and preparation will separate top performers from those struggling to elevate performance.

For many rural providers, uncertainty around how to improve capabilities around population health, consumer engagement, reimbursement, and remote care services is a barrier to improvement, the Azalea Health survey shows.

Lack of understanding around the ROI that would be gained from new approaches also is a stumbling block. And among independent rural hospitals, the larger the hospital, the greater the perceived difficulty of integrating new technologies into existing workflows.

Now more than ever, rural providers must be aware of new technology trends, research their options, and demonstrate their business use case to ensure complete buy-in from facility decision makers, be it the board or middle management. They must also seek ways to more effectively leverage existing technologies to maximize ROI.

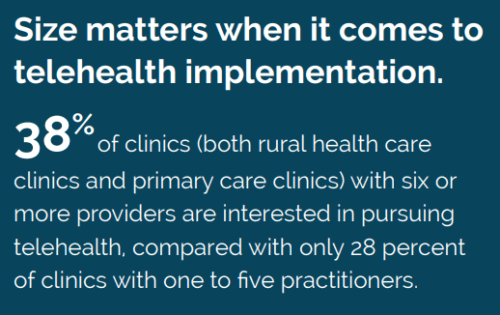

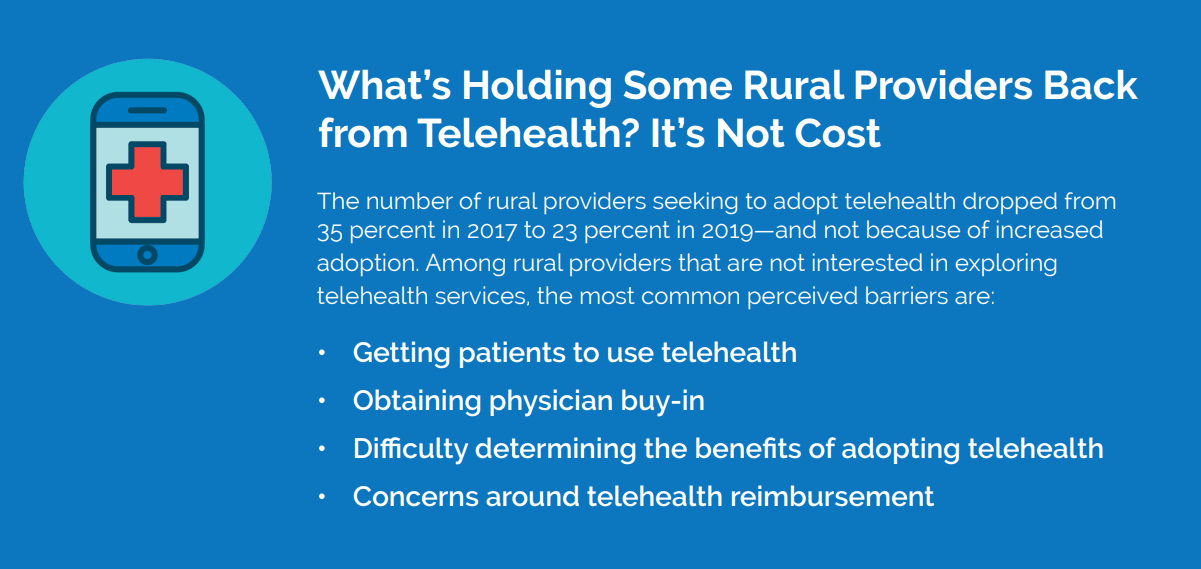

For example, nearly half of all rural hospitals say they would adopt a population health management tool if they could, but 21 percent do not understand the benefits. They also are not confident in their ability to engage patients in technologies that could be used for population health management, such as telehealth. Forty-one percent say the challenges they anticipate in getting patients to use telehealth is the biggest reason they won’t move forward. It’s a barrier that likely ranks higher than the cost of telehealth (38 percent) since telehealth can offer additional revenue streams.

Taking a Pulse on Population Health in Rural America

- Independent specialty care clinics are least likely to be interested in population health management and/or consider it a bad time for investment (50 percent).

- Nearly half of all rural hospitals would adopt a population health management tool, compared with 27 percent of all other rural providers.

- Yet one out of four rural hospitals can’t afford a population health management tool. Another 21 percent don’t understand the benefits. Only 7 percent are implementing such a tool.

- Advancements in quality reporting don’t rank high on rural health care centers’ wish lists. Forty-four percent believe their current system supports sufficient analytics and reporting. Only 22 percent said they would be interested in population health analytics software if they had the resources.

It could also point to alternative opportunities for improving population health that may make more sense for the organization given its staffing, technological capabilities, and resources. Additionally, careful review of existing technologies could point to entryways to population health management that complement existing workflows and make financial sense for the organization.

Ultimately, research and preparation will differentiate those organizations that know their appetite for risk from those that are continually following the crowd.

It could also point to alternative opportunities for improving population health that may make more sense for the organization given its staffing, technological capabilities, and resources. Additionally, careful review of existing technologies could point to entryways to population health management that complement existing workflows and make financial sense for the organization.

Ultimately, research and preparation will differentiate those organizations that know their appetite for risk from those that are continually following the crowd.

3 Strategies For Rural Healthcare Success

For rural providers to “act big” on their vision, they must arm themselves with the knowledge needed to overcome fears and misconceptions, change patient behavior, and elevate quality and financial performance.#1. Take Action To Ensure Your Financial Future

With nearly half of rural hospitals operating under negative margins, rural healthcare organizations can’t afford to operate from a place of skepticism when it comes to making decisions that could impact reimbursement, such as quality program participation or investment in new services. Moving from big vision to big action requires that rural healthcare providers take the time to:- Investigate which quality programs are best suited to their organization—and develop action plans for testing the waters.

- Understand the ways in which changes in reimbursement could propel investments in technologies that could make a big impact on patient health, efficiency, cost, and more.

- Talk with other rural healthcare organizations about how they’ve dealt with common challenges—and seek to apply the lessons learned

#2 Revamp Your Approach to Patient Engagement

Effectively engaging patients in their care can lead to improved quality, safety and efficiency. It can also reduce costs and elevate performance under VBP models, increasing reimbursement. Look for ways to more effectively engage patients at each stage in their care journey. Now may be the time to move mobile health apps from wish lists to reality for chronic care patients to move the needle on quality performance. Look at your 30-day readmission stats to determine whether incorporating mobile apps for care management could make a difference for specific types of patients—and generate the ROI needed to justify this innovation. Software vendors sometimes provide ROI analyses based on past performance to make the process easier for you. It’s also important to consider ways to more effectively engage patients in taking financial responsibility for their care. Consider providing front-office staff with scripting that mirrors these best practices from the Healthcare Financial Management Association:- Avoid surprises. Let patients know what to expect, including the potential for physician fees that are separate from the estimate provided.

- Find out whether patients will need assistance paying their bill.

- Communicate directly—cut to the chase.

#3 Educate the Board, Senior Leaders, & Physicians On Where Opportunities To Improve Key Capabilities Exist

Use data to highlight the impact of deficiencies in care management, revenue cycle processes, quality reporting, and patient engagement on the organization’s financial health or its performance under MACRA or other value-based payment programs. Then, present options for ways to build these capabilities internally or with the help of a tool or outside professional, focusing not just on cost, but the actions required from team members to achieve gains in performance. These are necessary steps in building an informed strategy and gaining input and buy-in from all key stakeholders. Approaches such as these will help rural providers better prepare for short-term and long-term challenges. It will also position rural providers as a stronger resource for their communities while improving the health of those they serve.Additional Sources:

1. National Rural Health Association, https://www.ruralhealthweb.org/about-nrha/about-rural-health-care#_ftn1

2. MGMA 2018 Regulatory Burden Survey, https://www.mgma.com/resources/government-programs/mgma-2018-regulatory-burdensurvey.

3. Daly, R., “MACRA Improvements Coming, Officials Say,” HFMA News, March 13, 2018.

4. Pellathy, T., and Singhal, S., “The Next Wave of Change for U.S. Health Care Payments,” McKinsey, May 2010.

5. National Rural Health Association, https://www.ruralhealthweb.org/about-nrha/about-rural-health-care#_ftn1

6. Perrin, A., “Digital Gap Between Rural and Nonrural America Persists,” FactTank, May 19, 2017.

7. “Hospital Pricing Transparency: 7 Financial Scripting Tips,” HFMA, Sept. 13, 2018.