Denials Management Post COVID

Introduction to Denials Management

The COVID19 pandemic brought forth a myriad of challenges for the healthcare industry. Telehealth exploded along with a litany of new reimbursement guidelines, procedures, codes, modifiers, claim and documentation requirements. Revenue Cycle professionals, while used to an ever changing industry were thrown into a fast moving whirlwind of changing codes, regulations, denials management challenges, claim requirements and payer guidelines. All of this while dealing with a shift to remove work and staffing shortages as organizations were forced to pull back fearing the worst.

This turbulent period of rapidly changing billing regulations, Increased workloads and staffing shortages contributed to increased backlogs of unworked denials. Revenue cycle professionals experiencing burn out left the industry or sought out new roles at different organizations. In addition, payers reduced staffing (in many cases permanently) leaving billing staff with limited options for assistance. Meanwhile payers continue to deploy more computer algorithms while hiring inexperienced staff contributing to a continual increase in confusing, unnecessary and often inaccurate denials.

The Facts

- The average cost to rework a denied claim is $25

- Up to 60% of denials are never resubmitted

- 90% of denials are preventable

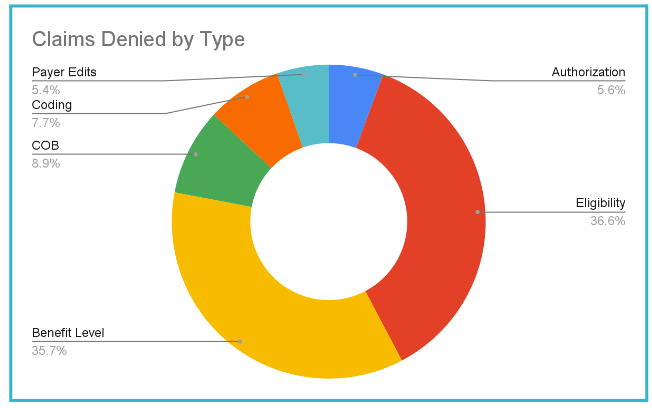

Top 5 Denial Reasons

- Authorizations

- Eligibility

- Coding & Modifiers

- Timely Filing

- Inaccurate Patient Demographics

Leveraging Analytics & Technology is Vital in 2024 for Denials Management

Leaning into technology and analytics is more vital than ever to address increasingly complex revenue cycle challenges, staffing shortages along with increased payer denials. RCM AI firms deploy bots and algorithms designed to analyze claim data and predict denials before they occur.

Analytics:

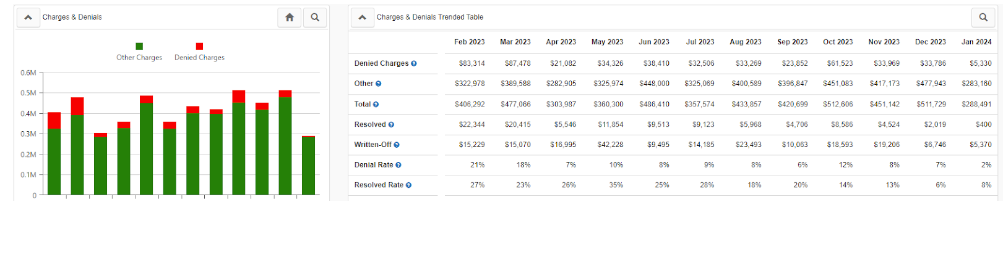

Does your EHR or clearinghouse offer analytics tools to quickly dive into denial trends and analysis? How quickly can you produce analysis on denials by type and by financial class? Are you able to track this data and trend it over time?

Encounter Alerts:

Does your EHR have customizable claim screening or encounter edits to catch potential denials before they happen? Are you continuously seeking out preventable denials (coding, claim errors) and building alerts to catch them before the claim is filed?

Automation:

Are you optimizing your revenue cycle staff by deploying automation tools? Maximize EDI enrollments for automated claims and payment posting. Spend the time learning what automation tools are available from your EHR vendor but not being utilized. The less manual workflows there are for simple tasks like posting payments and adjustments, the more time can be allocated to processing denials.

Payer Portals:

Having portal access in 2024 is more important than ever before. During COVID-19 many payers reduced internal staff typically dedicated to responding to claim status phone inquiries. This reduced staffing remains in place today and now many payers either have excessive wait times or no longer accept any phone calls for claim status. On the plus side you now see more payers deploy claim status chat options eliminating the need the pick up the phone.

Artificial Intelligence:

One of the first use cases of AI in RCM was for predictive denials. The goal is to identify a potential denial using machine learning-algorithms before the claim is submitted. These algorithms get smarter every year as new data is gathered and payer tendencies are mapped.

Developing a Proactive Denials Prevention Strategy

In healthcare, a preventative approach is desirable to our wellbeing as we seek ways as individuals to mitigate potential health concerns before they become serious. Unsurprisingly, setting a preventative strategy for denials is also highly recommended for a healthy financial organization. Despite the new challenges we face in revenue cycle management as outlined above, the core strategy to have a successful denials mitigation strategy remains the same.

Calculate Denial KPIs:

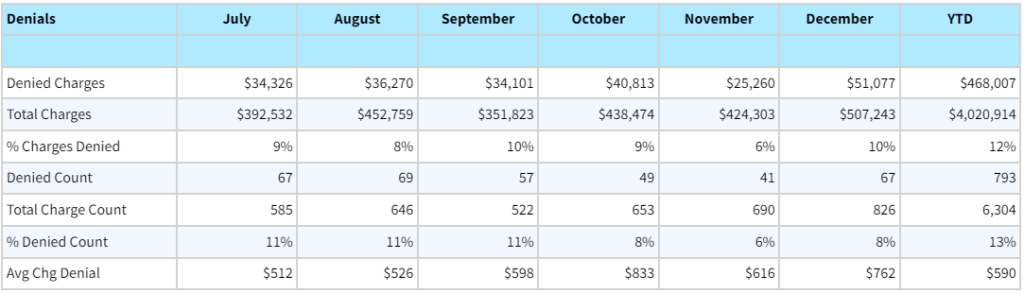

The average claim denial rate falls somewhere between 5 and 12%. A denied claim rate over 10% should be considered problematic. Trend these numbers over time to see if our efforts are having a positive impact.

- Denial Rate = Gross charges Denied/Gross Charges Filed

- Clean Claim Rate = # Denied Claims/ # Total Claims Filed

Determine Staffing Needs & Associated Costs:

According to MGMA, a denials specialist should be able to process 50 denied claims per 8 hour work day. Use this as a baseline to determine the amount of time and resources needed to catch up and stay on top of your denials backlog.Dive Into the Details: Analyze denial trends and identify areas of improvement

- Break down denials by type: (Coding, Elig, Auth, med Nec)

- Break down denials by financial class (Medicare, Medicaid, Commercial)

- Determine root cause of underlying issue

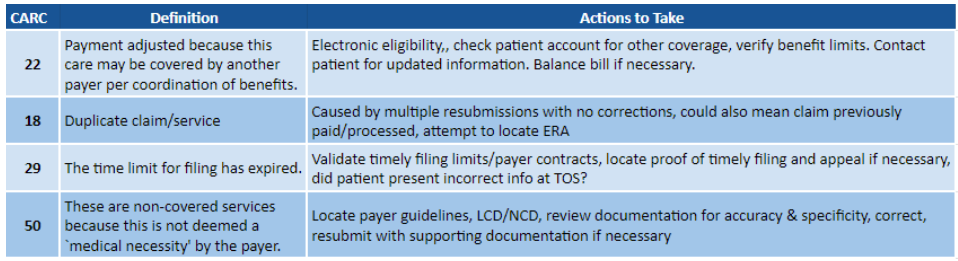

Build Denial Resources

- Build a library or index of most common denials by type payer along with suggested fixes or troubleshooting techniques

- Include Payer name, CARC codes, description of denial, and recommended action(s) to take in order to address

Communication & Prevention

- Complete training for staff aimed at preventing top denials

- Provide feedback to appropriate staff and hold them accountable

- Celebrate improvements & give recognition

- Seek to be Proactive instead of Reactive

Want to learn more?

Scheduling, charting, and billing has never been easier with Azalea’s award winning EHR platform. Schedule time to meet our experienced team so we can answer any questions you have on denials management and let us walk you through our simple drag and drop features, intuitive charting, integrated telehealth, and billing so you can eliminate navigating to multiple screens, experience fewer clicks, and get time back in your day.