OBBBA and RHT Program Resource Center

Updates and resources to help rural hospitals, clinics, and providers navigate the One Big Beautiful Bill Act (OBBBA) and the Rural Health Transformation (RHT) Program

What to Do Now

CMS has announced RHT Program funding. Register for the RHT Program Funding Is Here. Now What? webinar to find out what you want to be doing now. And read why Azalea EHR checks off critical RHT Program needs.

Check out the latest RHT Program fact sheet.

Understand your payer mix and how OBBBA changes could affect you.

What’s New & Noteworthy

- How Azalea EHR Satisfies RHT Program Needs

- Webinar: RHT Program Funding Is Here. Now What?

1 in 4

adults covered by Medicaid in rural America

2.7 million

10 million

people left uninsured nationwide by 2034*

$137 million

$911 billion

$50 billion

RHT Program funds to states over 5 years

$200 million

maximum RHT Program funds per state per year for 5 years

$87 billion

gap between reduced spending and RHT Program funding over 10 years

Source *Medicaid only, excludes ACA losses

RHT Program Funding Is Here. Now What? Webinar

Hear what states are likely to fund first, and what rural healthcare leaders can focus on now to avoid missing out or having to scramble later. The goal isn’t guessing. It’s getting ready.

- BLOG POST

How Azalea EHR Satisfies RHT Program Needs

Read how Azalea EHR satisfies specific approved RHT Program initiatives and is the best EHR for rural providers to maximize program funding.

Clinically Integrated Networks and Future Financial Success

Learn when clinically integrated networks make sense, what they are, how CINs relate to value-based care, and their benefits.

- ON-DEMAND WEBINAR

How to Navigate Rural Healthcare Grants in 2026

Get ideas for using different federal and private grants to help with the effects of the OBBBA along with tips on finding and applying for grants.

- ON-DEMAND WEBINAR

How to Mitigate OBBBA Impacts with Added Roles and Services

Find practical ideas for how your rural hospital or clinic can mitigate the impacts of the OBBBA.

- ARTICLE

Fee-for-Service vs Value-Based-Care — What to Know

Find out the difference between fee-for-service and value-based care and why value-based care can help rural hospitals and clinics increase financial stability.

- ARTICLE

OBBBA Medicaid Impact: Strategies for Rural Healthcare

Hear industry experts break down the OBBBA and share practical steps you can take now to prepare.

- FREE DOWNLOAD

Rural Health Transformation (RHT) Program Fact Sheet — updated January 1, 2026

Get key facts about the RHT Program, including a program overview, funding breakdown, eligible uses, and how to prepare for your share of its $50 billion in funding.

- ON-DEMAND WEBINAR

Navigating the OBBBA and the Rural Health Transformation Program

Hear industry experts break down the OBBBA and share practical steps you can take now to prepare.

- ARTICLE

How to Do a Payer Mix Healthcare Analysis to Prepare for OBBBA Impacts

Learn how to easily estimate how changes in Medicaid coverage might affect your hospital or clinical as OBBBA impacts take effect.

- BLOG

One Big Beautiful Bill Next Steps for Rural Healthcare

Get essential insights into the RHT Program — what it is, how the $50 billion funding is structured, who qualifies, and the steps you should take now to secure your share.

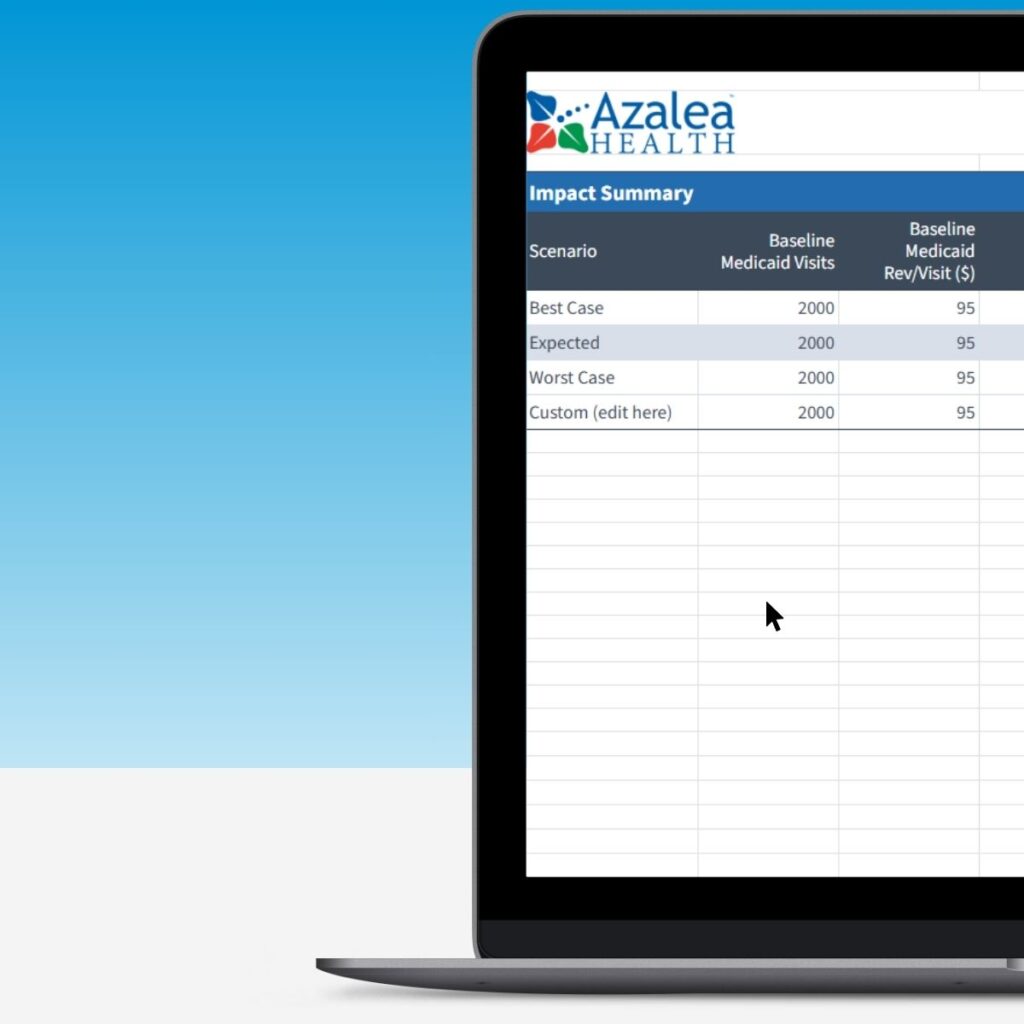

Payer Mix Impact Calculator

Understanding how the OBBBA and RHT Program may affect your payer mix is an important part of planning ahead. And this Payer Mix Impact Calculator lets hospitals and practices estimate the potential impact of coverage changes on patient visits and revenue.

With this tool:

- Uncover your current payer mix and revenue by category

- Compare best-, expected-, and worst-case scenarios

- Estimate your potential visit and revenue changes

- Adjust assumptions to reflect your patient population

This model gives leaders clear, scenario-based insights that support planning and decision-making. Downloads as a Microsoft Excel file. Watch an overview of using the calculator.

Discover Key Dates that Impact Rural Healthcare

Visit the OBBBA and RHT Program timeline to see key dates of both that affect rural healthcare along with impacts specific to Medicare, Medicaid, the Affordable Care Act, and the RHT Program.

Stay Informed

Keep up with trusted sources for the latest updates, expert takes, and in-depth info on the OBBBA and RHT Program.

A KFF analysis looks at the range of RHT Program m fund awards across all 50 states and includes a drill-down of dollars per rural resident.

CMS Awards RHT Program Funds to All 50 States

CMS announced that all 50 states will receive awards under the Rural Health Transformation Program.

CMS created an Office of Rural Health Transformation on December 18. The office will manage the RHT Program.

Princeton University’s State Health & Value Strategies maintains an interactive map with links to state RHT program application status and full applications when available.

CMS press release from November 5, 2025 shares that all 50 states submitted applications for a part of the $50 Rural Health Transformation (RHT) Program funding.

The National Conference of State Legislature’s resource page for the RHT Program with resources on multiple aspects of the program and what states can use funds for.

A new tool from Fitzhugh Mullan Institute for Health Workforce Equity lets you track Medicaid beneficiaries’ health care use through claims and the workforce that cares for them as you prepare to bid for RHT Program funds.

The Centers for Medicare & Medicaid Services (CMS) page on the RHT Program, including a timeline of application dates.

KFF offers five key takeaways from the RHT Program fund and information on how CMS will review applications and distribute funds,

Read the complete legislative text of the One Big Beautiful Bill Act as signed into law.

National Association of Rural Health Clinics’ (NARHC) summary and implications for RHCs.

The National Rural Health Association’s (NRHA) official position and advocacy points.

Ongoing analysis and data from KFF (Kaiser Family Foundation) on Medicaid policy changes and rural healthcare impacts.

Federal rural health policy and funding updates, including grant announcements and program guidance.

The Center’s assessment of the OBBBA’s impacts on Medicare and Medicaid and how it shifts federal health care policy.

By 2034, the bill’s provisions could reshape healthcare coverage for millions of Americans. While changes may affect up to 12 million people who rely on Medicaid and ACA plans, they also create an opportunity to reimagine how healthcare is delivered, especially in rural areas where 23% of residents depend on Medicaid. With more than 2.7 million rural residents potentially impacted, the Federal government, states, healthcare providers, and facilities may need to turn to innovative solutions that strengthen healthcare systems and payment models.

To offset the potential revenue losses from people who rely on Medicaid and ACA plans, the bill includes the rural Health transformation Program that allocates money for states to use for rural hospitals and healthcare providers.

The Rural Hospital Stabilization Act (H.R. 3063) hasn’t passed yet. It would allocate up to $5 million dollars in federal grants per rural hospital over a 5-year period. Funds could be used for operational costs, debt, and capital projects. Grants would be distributed by the HRSA Office of Rural Health Policy.

The Rural Health Transformation (RHT) Program was passed as part of the OBBBA (H.R. 1). It’s a state-directed program administered by CMS. States must submit plans on how the money will be used in September 2025 and are responsible for distributing funds. States can plan for rural health care providers, including hospitals, health clinics, federally qualified health centers, and community mental health to use funds for provider payments, workforce recruitment and training, new technologies, support for opioid use treatments, mental health services, preventive care, and chronic disease management. The program provides for $50 billion in funding — $10 billion per year through 2030, $2 billion in 2030 and 2031 and $1 billion in 2032. Half of the funds will be distributed equally across states whose plans CMS approves. The other 50% will be given to states with approved plans based on the state’s rural population, number of facilities, and other factors not yet announced.

While the funds are intended for rural hospitals and providers, the law gives states discretion in how funds are distributed.

Things you can do today to understand how the bill may impact your practice or facility include understanding your payer mix. For example, calculating your percentage of visits or reimbursement from Medicaid payers or ACA plans will give you an idea of your potential decrease in volume or revenue. You may also want to review and update your charity care policies considering you may see an increase in uninsured people in your area.

The OBBBA will reduce Medicaid provider tax limits in expansion states from 6% to 3.5% by 2032. This could make it harder for states to fund Medicaid and lead to potential cuts in services, reduced provider reimbursements, or the need for states to raise taxes in other areas or find innovative solutions.

The bill caps SDPs at 100% of Medicaid rates in Medicaid expansion states and 110% in non-expansion states. SDPs paid at higher rates today will be reduced by 10-percentage points a year starting in 2028 until they reach the new limits. Rural hospitals are an exception. Payments for rural hospitals approved before May 1 2025, that exceed the new limits aren’t affected.

The Definitive Guide to Rural Health

Get proven strategies, tips, and solutions to thrive as a rural hospital, clinic, or provider.

Disclaimer: This page is updated regularly as new information becomes available. The content provided reflects Azalea Health’s understanding of the One Big Beautiful Bill Act (OBBBA) and related programs as of the latest update. It is intended for informational purposes only and should not be considered legal, financial, or medical advice. Please consult official sources or qualified professionals for guidance specific to your organization.