What Are RVUs in Healthcare and How Are they Calculated?

RVUs stands for Relative Value Units. RVUs in healthcare are non-monetary units used to quantify the value of medical services. RVUs reflect the relative amount of work, practice expense, and malpractice risk used to deliver different procedures or services. Each service or procedure provided is assigned an RVU based on the resources and effort required. Medical codes are then based on the component RVUs.

RVUs are a key factor in how physician payments are calculated. Knowing the RVUs assigned to different types of services can help physicians understand how their productivity is measured.

This article examines what RVUs in healthcare are and how they’re calculated.

What Are RVUs in Healthcare and What Is Their Value?

RVUs are measures used to help create consistent comparisons across healthcare services and procedures. They reflect the relative complexity of a service or procedure instead of its price. Payers, including Medicare, use RVUs as a foundation for determining reimbursement rates. Providers and healthcare organizations can also use RVUs to measure productivity and support compensation models.

RVUs are tied to CPT (Current Procedural Terminology) codes that represent a specific medical procedure or service. Each CPT code has a corresponding RVU value based on three components: the estimated work required, practice expenses, and malpractice risk involved. These RVU components are standardized and published annually by the Centers for Medicare and Medicaid (CMS).

There are Total RVU values for medical procedures or CPT codes ranging between 0.03 and 364.96. The values get gradually higher as the difficulty or complexity of a service or procedure increases. For example, something as simple as collecting sweat for testing has an RVU value of 0.09, but a Cesarean delivery or C-Section is significantly higher at 80.89 RVUs.

CPT Code | Description | Total RVU Value |

89230 | Sweat collection by Iontophoresis | 0.09 |

93000 | Electrocardiogram complete | 0.43 |

99212 | Office/outpatient visit for an established patient, 10 minutes | 1.70 |

99213 | Office/outpatient visit for an established patient, 20 minutes | 2.75 |

44370 | Small intestine endoscopy (enteroscopy) | 7.88 |

59510 | Cesarean delivery (C-section) and related routine obstetric care including antepartum care (prenatal) and postpartum care | 80.89 |

Sample CPT Codes and the associated Total RVU values for non-facility services/procedures for each for 2026. Source MedFeeSchedule.com.

Procedures with higher RVU values typically require more technical skill, time, and complexity. Productivity benchmarks calculate total work RVUs (wRVUs) over a set period of time to compare a provider’s performance against regional or national benchmarks.

Many practices and healthcare organizations use RVU-based compensation plans to incentivize productivity and quality of care. Provider productivity is influenced by patient visits, how many patients are seen per day, the mix of new patients, and the complexity of services provided. Tracking these metrics helps optimize scheduling, improve revenue, and ensure fair compensation based on services provided.

The History of RVUs in Healthcare

Up to the late 1980s, Medicare reimbursements were based on Customary, Prevailing, and Reasonable charges (CPR). Calculating reimbursements using CPR created inconsistencies.

To address the inconsistencies, CMS worked with The Harvard Group to develop the Resource-Based Relative Value Scale (RBRVS). The system was authorized by Congress at part of the Medicare Physician Fee Schedule in 1989. It remains the industry standard for benchmarking and measurement today.

The RBRVS took several years to complete and included guidance from more than 200 physicians across 33 specialty groups. The result of their findings was a table of values, for each CPT code, representing the work and services, categorized by both time and intensity (with intensity including mental effort, clinical judgment, technical skill, physical efforts, and stress-related to risk). The values were designed to be “relative.”

The foundational code used to create the entire RBRVS was 99213, an established patient office visit with face-to-face time lasting approximately 15 minutes. At the time, a 99213 was assigned a RVU of 1.0, which has since changed to 2.75 for non-facility visits.

Today, the AMA’s Relative Value Scale Update Committee (RUC) reviews and advises CMS on Medicare RVU values to help CMS ensure fair valuation of medical services across specialties.

And the Medical Group Management Association (MGMA) provides national benchmarks for work RVUs and physician productivity that practices can use to compare performance across different specialties and practice types.

Types of RVUs

RVUs are the foundation of the Medicare Physician Fee Schedule and play a key role in how practices determine payment for physician services. Each medical service or procedure is assigned a set of RVUs that reflect the resources required to deliver care. There are three main types of RVUs.

- Work RVUs (wRVUs): Work RVUs measure the provider’s time, technical skill, mental effort, and judgment needed to deliver a specific service. They also account for the physical effort and stress related to patient risk. Work RVUs are often used by practices to benchmark productivity and set physician compensation.

- Practice expense RVUs (peRVUs): Practice expense RVUs capture the overhead costs of running a medical practice. This includes expenses for clinical staff salaries, medical supplies, equipment, and facility costs. PeRVUs ensure that the fee schedule reflects the true cost of delivering care beyond just the provider’s work.

- Malpractice RVUs (mpRVUs): Malpractice RVUs are the portion of payment that covers the cost of malpractice insurance for a service. They vary depending on the risk associated with the procedure and the specialty involved.

Together, the three types of RVUs are combined and adjusted for geographic practice cost differences to determine the total payment for each service under the physician fee schedule.

How Are RVUs Calculated?

One RVU (Total RVU) is made up of the three types of RVUs and a geographic adjustment when applicable.

Component | Description | Percent of Total RVU |

Work Relative Value Unit (wRVU) | The provider’s time and effort for a procedure and/or service; the work GPCI is applied to this component to adjust for regional cost differences | Roughly 50% |

Practice Expense Value Unit (peRVU) | The expense to provide the procedure and/or service; updated and adjusted based on geographic region and place of service | Roughly 44% |

Malpractice Risk Value Unit (mpRVU) | Cost for malpractice insurance for a given procedure and/or service and specialty; reflect the cost of professional liability insurance based on an estimate of the relative risk associated with each CPT code | Roughly 4% |

Geographic Practice Cost Index (GPCI) | Adjustment to total RVUs based on geographic location; applied separately to each RVU component (work GPCI, PE GPCI, and MP GPCI) to reflect regional cost variations | Applied to Total RVU |

The Geographic Practice Cost Index (GPCI)

The Geographic Practice Cost Index — commonly called Gypsy — is used by CMS to address differences in practice costs based on a provider’s geographic location.

For example, procedures done in rural vs metropolitan areas can vary in cost and effort. GPCI multiplier values for major geographical areas are broken out by Work, Practice Expense and Malpractice Risk. See the comparison below. You can see that RVUs for Alaska are multiplied by 1.5 in order for it to be normalized with the rest of the country.

State | Locality | Locality Name | 2025 PW GPCI | 2025 PE GPCI | 2025 MP GPCI |

AK | 01 | Alaska | 1.500 | 1.081 | 0.592 |

CA | 07 | San Francisco (Marin County) | 1.088 | 1.419 | 0.470 |

CO | 01 | Colorado | 1.008 | 1.053 | 0.827 |

FL | 04 | Miami | 1.000 | 1.027 | 2.500 |

GA | 01 | Atlanta | 1.000 | 0.997 | 1.128 |

NY | 01 | Manhattan | 1.065 | 1.166 | 1.656 |

Source: cms.gov Search the Physician Fee Schedule

So, an individual service or procedure’s Total RVU is actually each of the three RVUs multiplied by the location’s GPCIs.

[( wRVU x wGPCI) + ( peRVU x peGPCI) + (mpRVU x mpGPCI)] = Total RVU

Total RVU values are predetermined by CMS down to the level of state and county. Providers simply pull them from CMS’s value files. GPCIs can be found by searching the Physician Fee Schedule on cms.gov.

How RVUs are Calculated for Physician Fee Schedule Pricing

CMS uses Total RVUs and a Conversion Factor (CF) dollar amount to calculate the physician fee schedule (PFS) reimbursements. CMS multiplies each Total RVUs by the CF to calculate allowable pricing. The conversion factor for 2026 is separated into two parts:

- Qualifying alternative payment model (APM) participants (QPs) — $33.57

- Non-QP participants — $33.40

Rates in 2025 were $32.35 for both QPs and non-QPs. This change is the first payment increase for physicians since 2020. Note that anesthesia has a separate CF called the Anesthesia Conversion Factor.

While providers don’t make RVU calculations themselves, understanding how CMS calculates pricing for each service can be helpful. And Medicaid, private payers, and commercial insurers also use RVUs and the RBRVS to determine physician reimbursements.

The complete formula that CMS uses to determine PFS pricing is:

[( wRVU x wGPCI) + ( peRVU x peGPCI) + (mpRVU x mpGPCI)] x CF = PFS pricing

Below is an example for the Total RVU for CPT 99213 for a non-QP provider in Colorado.

Allowable CPT pricing per the PFS = [(wRVU × wGPCI) + (peRVU × peGPCI) + (mpRVU × mpGPCI)] × CF

CF 2026 = 33.40

Work | Practice Expense | Malpractice Risk | |

CPT 99213 RVU Values | 1.300 | 1.46* | 0.09 |

Colorado GPCI Values | 1.008 | 1.053 | 0.827 |

Source: cms.gov Search the Physician Fee Schedule* using the fully implemented non-facility value.

CPT 99213 RVU and GPCI values

- 99213 = (1.30 × 1.008) + (1.46 × 1.053) + (0.09 × 0.827) × 33.40

- 99213 = (1.3104 + 1.53738 + 0.07443) × 33.40

- 99213 = 2.92221 × 33.40

- 99213 = $97.60 allowable pricing for a non-QP in Colorado

On January 1, 2026, several updates changed how RVUs are applied. Reimbursement is shifting toward office-based care through a 50% reduction in indirect Practice Expense RVUs for facility-based services, alongside a 2.5% reduction in work RVUs for approximately 7,700 non-time-based procedures to account for efficiency gains due to technology. Additional site-of-service changes and efficiency adjustments will also influence RVU calculations and reimbursement outcomes.

Where to Find RVU Values

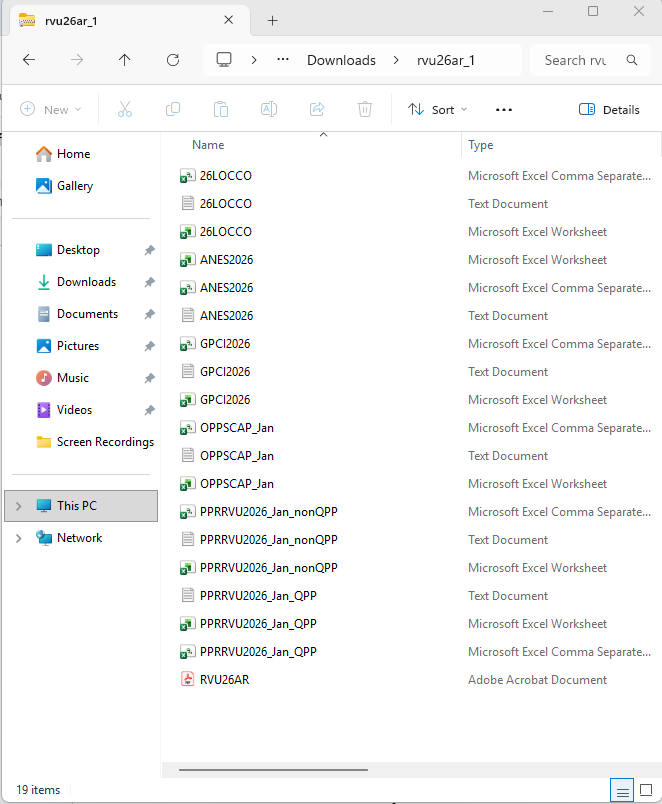

You can access RVU values by year on the PFS Relative Value Files page on cms.gov. RVU values change each year, so always make sure you’re current. When you select the year, you’ll be taken to a page where you can download a Zip file of RVUs for QPPs, nonQPPs and more, as well as an overall list of RVU values in a PDF.

PFS Relative Value Files for 2026. RVUs are in the files tilted PPRRVU2026-Jan. Separate files cover QPP and non-QPP rates. You can also look up RVUs using the Search the Physician Fee Schedule Tool on cms.gov or medfeeschedule.com. On medfeeshecule.com, enter https://www.medfeeschedule.com/code/99213, where the last 5 numbers are the code you want to see to get an automatic total of Total RVUs based on non-facility versus facility rates.

How to Apply wRVUs to Internal Measurements and Compensation

You can use RVUs to analyze practice revenue cycle areas, such as productivity, cost, payments and payer contract reimbursements. Physician compensation often includes a base salary plus a production bonus based on RVUs. RVU, or Work RVUs, can be analyzed to give raises, set new hire salaries, do contract negotiations, assess provider or practice performance, benchmarking, and more.

You want to establish work RVU benchmarks at the beginning of the fiscal year and include them in productivity reports, so physicians can see whether they’re meeting work RVU goals. Incentivizing providers to properly code or to achieve higher patient volumes can drive performance improvements in productivity and profitability.

There’s a direct correlation between work effort, RVU values, and revenue. In a future article, Azalea health will cover how to use RVUs for internal measurements and compensation.

wRVU Calculator

Now that you understand the RVU formula and how to calculate RVUs, you can use an RVU calculator to find the total work RVUs for each code based on CMS’s Total RVU and how many times you performed that particular procedure or service. Simply input the CPT code, the number of units (how many times you performed that particular procedure or service), and other variables to calculate the RVUs for your practice.