Healthcare Industry Consolidation Trends: What Is Happening & Why

The healthcare industry has long been politicized and regulated. While it has its struggles, it also has had its times of off-the-chart growth. We saw this begin in 2009 with the American Recovery and Reinvestment Act (ARRA). Enacting new government regulations and requirements on technology vendors and incentivizing and mandating EHR technology at all levels of healthcare – hospitals, clinics, and practices – ARRA spurred the industry into growth. In the first 5 years, we saw EHR adoption rates at hospitals nearing 96% and 75% of ambulatory physicians adopting certified EHR systems. The opportunities were plentiful, and EHR vendors raced to lock-down their piece of the pie.

In 2018, we see a totally different landscape. Health IT vendors and hospital execs are getting creative in how they can continue to grow their revenue.

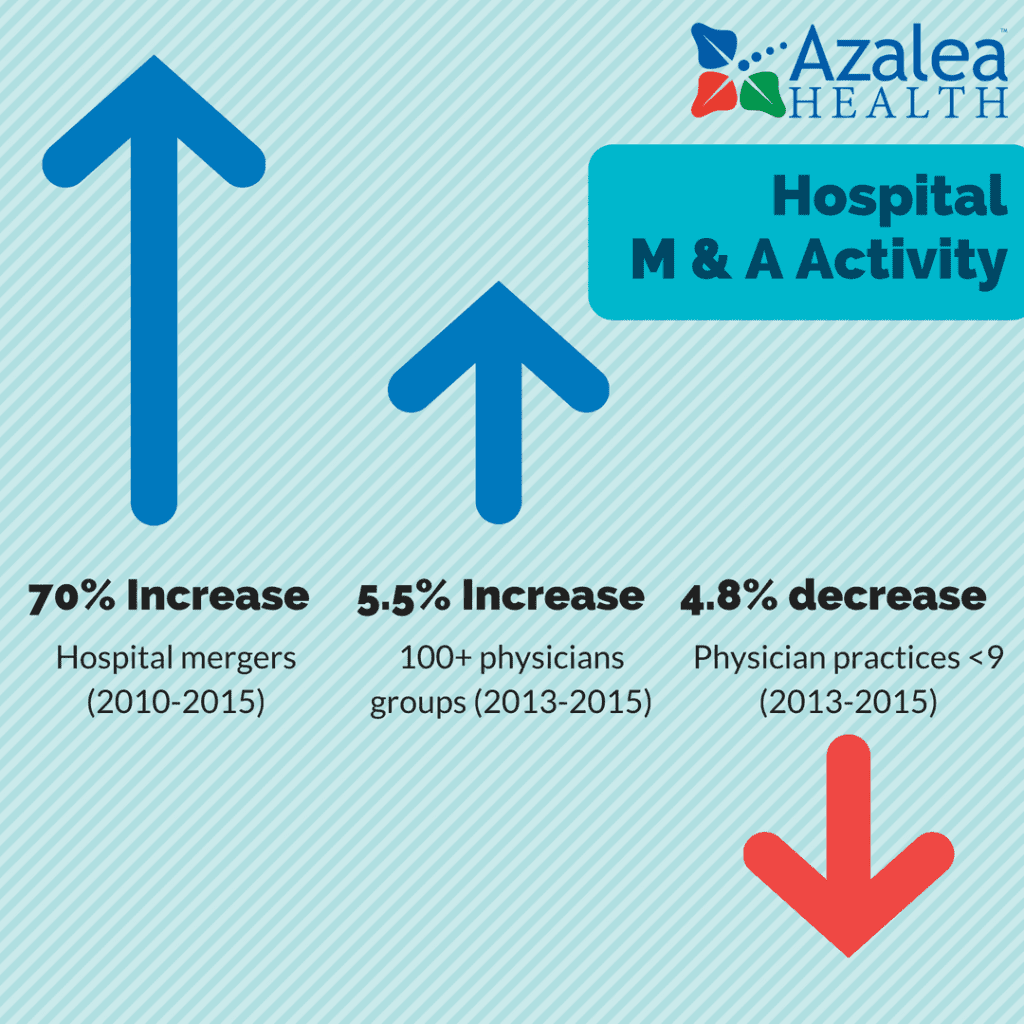

Hospitals & Physicians Consolidation

Many forces are at play in creating this consolidation environment, the key factors to consider are: technology pressures, cost containment, reimbursement penalties, government mandates and increased population health management initiatives. Below is a look at the sizeable activity the industry is undergoing.

- 457 mergers from 2010-2014

- Hospitals: 115 transactions in 2017 (highest in volume since tracking in 2000)

- The total number of deals in 2017 represents close to a 13% increase from 2016.

- Many of those deals included big price tags—11 deals in 2017 involved sellers with net revenues of $1 billion or more.*

Vendor Consolidation

With most providers and hospitals locked into contracts with EHR vendors, Health IT has started to see more than its fair share of acquisitions. According to Bank of America’s survey of 245 healthcare executives, 75% believe merger and acquisition activity will increase in 2018. Vendors are looking at acquisitions that allow them to expand service offerings thus revenue within their existing customer.

While consolidation is happening, it did dip in 2017, but it is expected to increase in 2018. Overall Health IT funding for 2017 was at $5.8B compared to $4.4B in 2016. 60% of companies funded sell directly to physicians.

What is causing hospital and EHR vendor consolidation?

The need for business growth:

- New Customers

- New Services

- Geographic Expansion

- Market Expansion

- Technology Advances

The EHR market is competitive and shrinking. We see companies seek out acquisition when they are unable to create new revenue or meet revenue goals.

- Pharmacy chain buys major insurer (CVS/Aetna)

- Amazon to sync up with two financial firms to “disrupt” healthcare

- United Healthcare’s Optum purchasing DaVita (dialysis centers) adding to is 30k physician roster moving into direct care

- Azalea Health has acquired two companies in the past year – expanding our offerings to support rural hospitals and clinics.

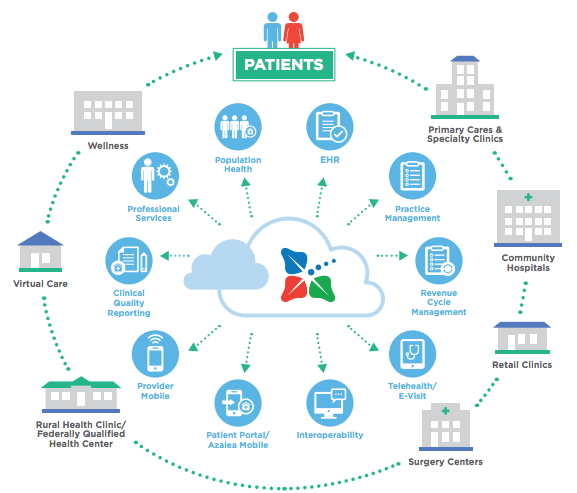

Future-Proof Your Hospital and Clinic

Now more than ever, it is important to work with a vendor you know has future-proof technology to support your hospital, practice, and clinic. Azalea Health has invested heavily into our vision of “One patient. One record.” Now offering a complete continuum of care – hospital, clinic, and home – Azalea Health is poised to support health systems achieve their business goals.

Click here to learn more about how Azalea Health can support your practice!

*Sources: Report from Kaufman Hall – https://www.kaufmanhall.com/sites/default/files/2017-in-Review_The-Year-that-Shook-Healthcare.pdf